So, You Haven’t Saved for Retirement?

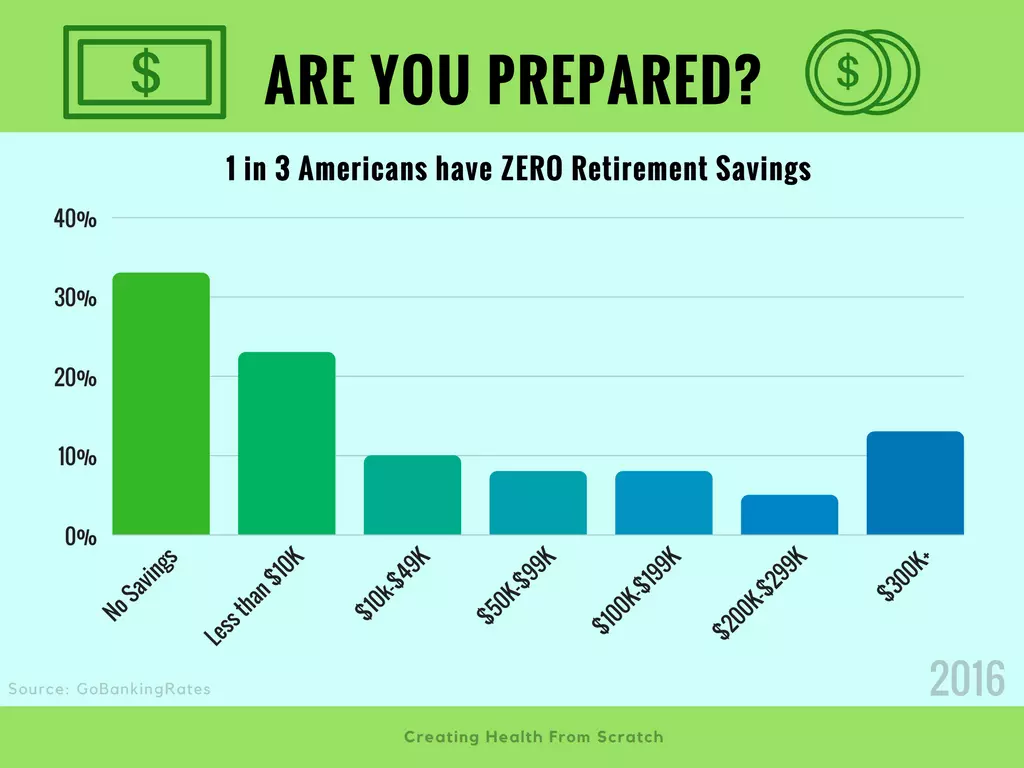

You’re not alone. One out of 3 Americans have saved exactly ZERO for retirement. Most of the remaining 67% haven’t saved enough.

For many, retirement is that pot of gold at the end of the rainbow they never quite find. We might talk of retirement at least half our lives, dreaming about all that we will do once we can retire, but so many people never get around to preparing for it…and now that we’re in our 40s-50s-60s the panic has set in. WHAT SHALL WE DO? How shall we survive? How can we make up for lost time?

Even if you haven’t started saving for retirement, even if you’re getting closer and closer to retirement age, if you’re still living and breathing, there are things you can do to overhaul the size of your nest egg.

Breathe. Let’s look at the bigger picture to see where you stand now compared to where you’d like to be down the road.

How Much Do You Need to Retire?

First, it’s helpful to know what you need (in a perfect world). There are a few ways to come up with that magical number. You can calculate what you make now, add 3.8% to the number (to account for inflation and salary growth) to come up with a salary for the future. Adjust that number by 70-90% to get your retirement yearly income (say you come up with $60,000, so your retirement income would be $42-54,000/year–let’s round it up to $50,000 just for ease of illustration).

So, you need $50,000/year in retirement to stay at a relatively same level of living as you enjoy pre-retirement. This number can be adjusted up or down depending on a few factors such as your health, your retirement plans, the business and work expenses you’ll no longer have, etc.

From that $50,000/year target, you can subtract any sorts of retirement income you might already have in place as well as any social security you will have coming to you (if you want to know how much your estimated social security payments will be, you can find out free here.

For sake of illustration, say you are going to get $2,000/mo from social security and you haven’t saved anything else. That means you’re short $26,000/year.

At this point, some advisers recommend using the 4% rule. This rule basically says, withdraw 4% of your retirement savings (plus inflation) per year to live on. If you need $26,000/year then you’ll roughly need a retirement savings of $650,000. (Breathe.)

There are many retirement calculators out there that will help you do the math. They even calculate in how many years past retirement that you think you’ll likely live. Here’s one I found that works pretty well. But remember, at this point we’re just trying to come up with a general idea of what you need versus what you have, and what you will have coming to you once you retire.

So, Maybe You’re a TON SHORT. Now What?

How can you go from zero (or even $10,000 or $200,000 or more) to $650,000 in a few short years? That number might seem unreachable to you but having a plan will help you get closer to it than just stressing out about how far away you are from the goal. A plan gives you something to strive for, something to measure your progress by, and something proactive you can do to help the situation (stressing is not proactive).

Here are a few questions to help you come up with a plan:

- How much are you able to save every month right now?

- How many years do you still plan on working?

- How much debt do you have?

- How is your health?

- What age do you hope to retire?

- Will you continue to work, even part-time, after you retire?

Answering those questions will help you get a clearer picture of what you’ll be striving for.

Ways to Bridge the Gap

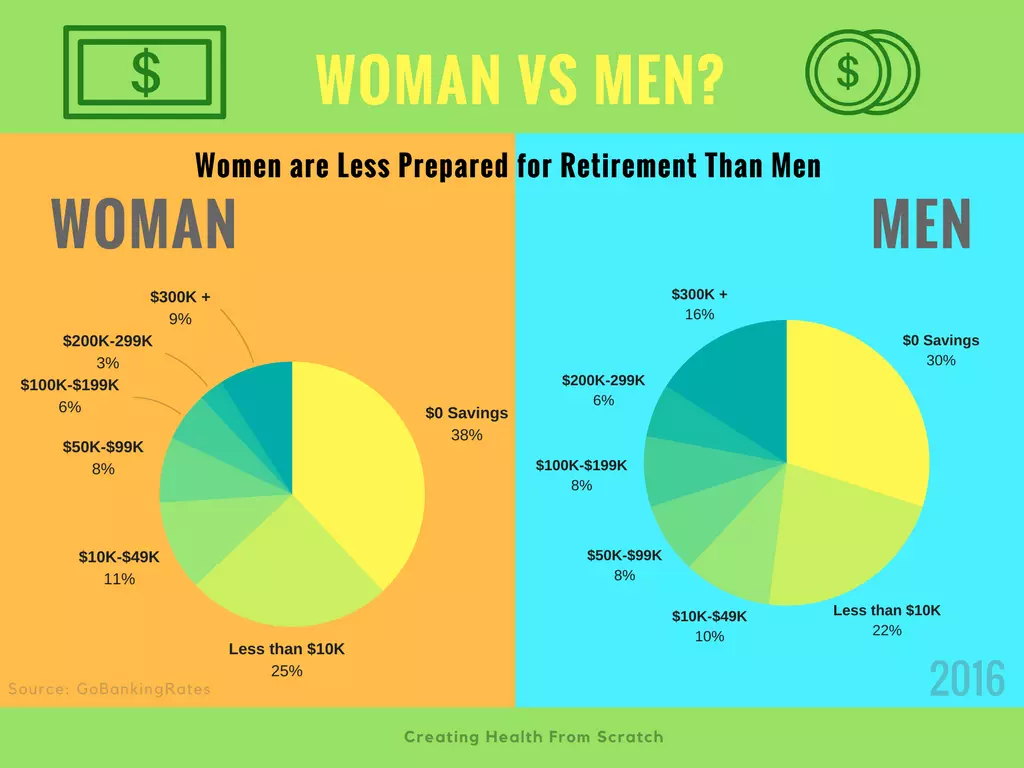

Since only 9% of women and 16% of men have saved $300,000 or more for retirement, you’re coming up short in what you have calculated you need for retirement. But, you’re already taking steps in the right direction. You know what you need. And you’ve considered variables that will affect how much you will need to make up. Now it’s time to think creatively and see how you can start catching up. Here’s a few ideas to get you started:

Visualize it First (and Write it Down)

Get a clear picture of what you want your life to look like at retirement. If you get a super clear picture of what you’re hoping for, it helps give you the emotional motivator to take consistent action. Studies indicate if you write down your goals, you’re 33% more likely to accomplish them.

Don’t Wait

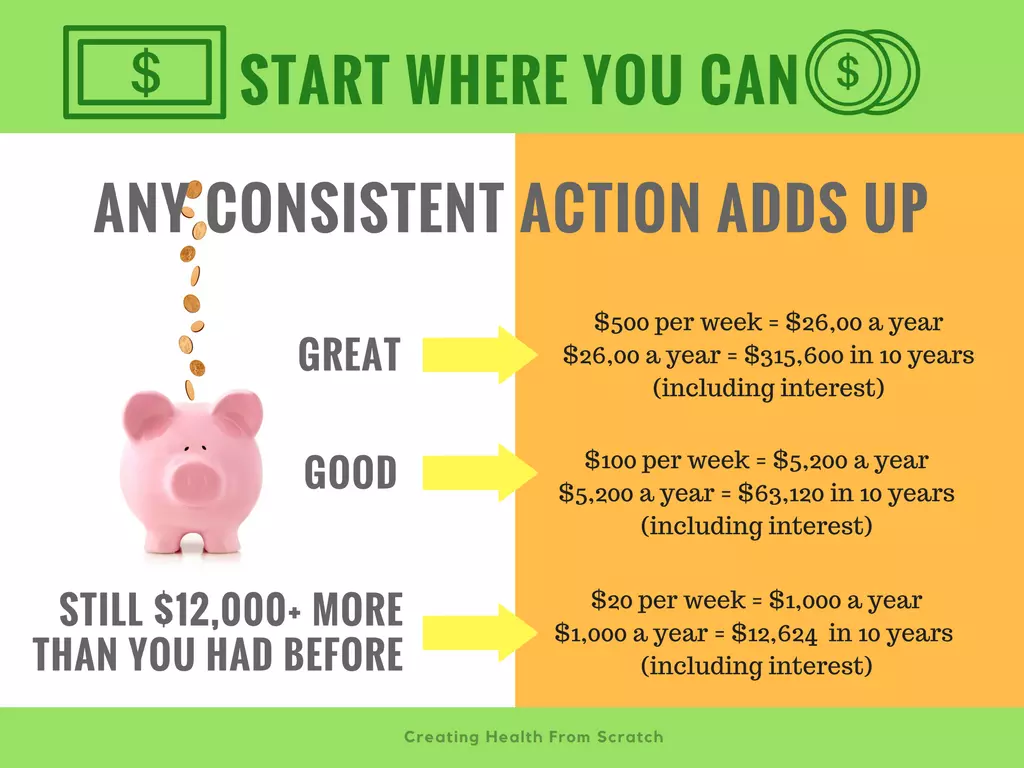

Start now. Save whatever you can, no matter how small. Even if its way less than your calculations are telling you they should be, at least you’re beginning to move in the right direction. And that is empowering. Check out this information about how much you should have saved based on age and income….the earlier you start, the less you have to save (because interest works for you).

Take Care of Debt First

Getting out of debt now is super important. The sooner, the better. Use the ‘snowball method’ to aggressively attack debt. Freeing yourself from debt will also free up your income, thus allowing you to save more, faster.

Consolidate Savings Plans

If you’ve had a number of jobs where you have paid into a 401(k) fund, pull them all together into one place.

Downsize

Look at ways you can save now (and/or reduce debt) to help you free up money to save. Can you move into a smaller house? Drop one of your extra vehicles? Cancel cable? Eat out less? These things add up fast and can make a big dent in your savings plan if you stay dedicated to the end goal.

Stay Healthy

Do the things you need to do to keep yourself healthy. Eat right, exercise regularly, get enough sleep. While these things are not a magical-unicorn-get-out-of-jail-free-card, they do significantly up your chances of staying healthy. And healthy people don’t miss as much work, nor spend as much money on medical expenses as sick people do.

Think of New (Non-Job) Ways to Earn Money

Pick up some extra income and dedicate all that income to your retirement fund. For example. Rent out a room (full-time or as a vacation rental like Airbnb), sell off a collection, find a credit card that offers cash back, etc.

Pick up a Part-Time Job

Work a part-time job to earn extra income. It doesn’t have to be a year-round job, even a seasonal job will help. (Think holiday season, or summers if you live somewhere that is a popular travel destination, etc.) Or teach a skill a couple of hours a week on your own time (without working for someone else). Save ALL the money you earn for retirement (or for getting out of debt).

Set Yourself up for Passive Income

Passive income is income you make over and over for work you do once (versus the traditional job where you get paid based on the hours you work). Passive income can take a variety of forms. Write a book (or eBook or other digital downloads) and sell it online. Start a blog. Affiliate marketing. Stock photography. Network marketing (like this), webinars, etc. Here’s a list of 43 passive income ideas.

Educate Yourself

There is TONS of information out there on the Internet as well as lots of free (or inexpensive) classes you can take to learn more about your options and strategies. Check community colleges (their community ed classes), local banks/credit unions and area community centers for resources. The more you learn, the wiser your choices and planning will become.

Talk with a Professional

Talk to someone who does this for a living. They will know things you don’t and will be able to help you in specific ways. They can also advise you in ways to wisely invest what you can to help your savings grow.

Get a Partner

Find someone who will agree to be your accountability partner. Just like writing down your goals, an accountability partner significantly increases your likelihood of accomplishing your goals. Not only that, they will be a great cheerleader and remind you (when you forget) why you are doing this.

Retire Later

Don’t retire at 65. Work a year or two longer. This will allow you to not only make more money (and thus save more) but it will also be fewer years your retirement fund will have to support you.

Retire to Part-Time

If the idea of full-time work past retirement age sounds terrible, consider a part-time job to supplement what you’ll need for a while after ‘retirement’. Even working an extra 1-3 years beyond retirement can greatly impact your income and savings.

Contribute Extra

If you’re over 50, the IRS allows you to save an extra $6,000 per year in a retirement savings plan to help you make up for lost time.

Stay Consistent

No matter how discouraging your situation, or how slowly you build your savings, determine now you will stay committed to your plan. Even tiny steps in the right direction will add up over time. Saving $20 a week while looking at the bigger picture of your overall retirement needs might feel a bit like trying to bail out a sinking ship with an eye dropper. But any effort you make is a step in the right direction and it will make life easier for you when you retire.